The Lacto Japan Group's business is based on dairy farming and livestock farming, which are primary industries, and we recognize that the impact of climate change is the most important issue affecting the very foundation of our business. To coexist with primary industries and contribute to a sustainable society, the Group is committed to addressing climate change in order to realize a decarbonized society.

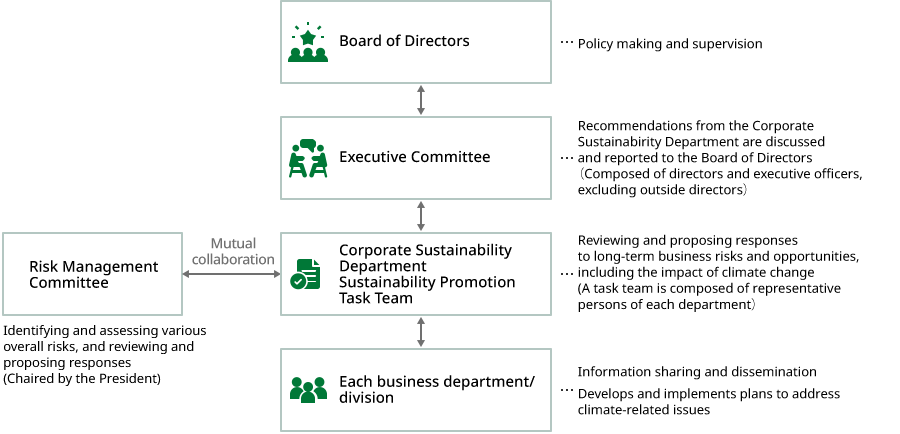

In the Group, the basic policy and important matters related to environmental issues, including climate-related issues, are discussed by the Executive Committee and decided and supervised by the Board of Directors.

The Group has newly established the Sustainability Promotion Department to grasp changes in the business environment due to climate change, identify medium- and long-term climate-related risks and opportunities, and study Group-wide responses. While sharing information with each division and department, the Sustainability Promotion Department submits climate-related issues it has examined and proposals such as measures to be taken to the Executive Committee in conjunction with the Group-wide Sustainability Promotion Task Team.

In addition, the Sustainability Promotion Department sets targets and manages progress in addressing climate-related issues, and considers additional measures as needed in conjunction with the Sustainability Promotion Task Team. These measures are deliberated by the Executive Committee and reported to and supervised by the Board of Directors.

Considering the possibility that climate-related issues may also materialize in the medium to long term, the Group identifies climate-related risks and opportunities that could have a significant impact on the organization's finances in the short, medium, and long term. Moreover, we discuss the potential impact of these identified risks and opportunities on the business and financial plans and utilize them in the consideration and formulation of the Group's strategy.

Climate-related risks and opportunities are identified based on medium-term (2030) and long-term (2050) world scenarios, assuming a 1.5°C scenario consistent with the Paris Agreement target and a 4°C scenario in which no measures to reduce global warming are taken beyond the status quo. In our scenario analysis, we refer to the following scenarios published by external organizations.

The Group has bases and is operating businesses in ten countries worldwide, as well as Japan. Furthermore, the products handled by the Group and their ingredients are produced in a wide range of countries and regions, including Europe, Oceania, the United States, and Asia, and we conduct scenario analysis that takes regional characteristics into account.

|

World view |

Transition scenarios |

Physical scenarios |

|

1.5℃ |

|

|

|

4℃ |

|

|

The Group analyzes the entire value chain using multiple climate-related scenarios to comprehensively identify climate-related risks and opportunities. In addition, we identify risks and opportunities that are expected to have a particularly significant financial impact, taking into account the magnitude of the impact on our group's finances if they materialize and the duration over which the financial impact is expected to last.

Climate-related scenarios and the resulting risks and opportunities for the Group are regularly reviewed.

|

Type of risk |

Assumed risks and financial impacts |

|

|

Transition risk |

Policies and regulations |

|

|

Transition risk |

Market |

|

|

Transition risk |

Market |

|

|

Transition risk |

Market |

|

|

Transition risk |

Reputation |

|

|

Transition risk |

Reputation |

|

|

Physical risk |

Chronic |

|

|

Physical risk |

Chronic |

|

|

Type of opportunity |

Assumed opportunities and financial impacts |

|

Energy sources |

|

|

Products and services |

|

|

Products and services |

|

|

Products and services |

|

|

Reputation |

|

|

Reputation |

|

The Group has developed measures and is pursuing activities to address the significant climate-related risks and opportunities that have been identified.

|

Measures to address risks and opportunities |

|

|

|

|

|

|

|

In the Group, the Sustainability Promotion Task Team, a Group-wide organization operated by the Sustainability Promotion Department, identifies and assesses climate-related risks based on scenario analysis. Identified climate-related risks are reported to the Risk Management Committee, chaired by the President, and integrated into Group-wide risk management. In addition, the identified major risks and opportunities are reported by the Sustainability Promotion Department to the Executive Committee for approval.

Measures to address risks are reviewed by the relevant business divisions, and plans are formulated and implemented. The formulated measures and plans are reported by the Sustainability Promotion Department to the Executive Committee for approval. The progress of the plans is also reported to the Risk Management Committee and subsequently to the Board of Directors.

Going forward, we will monitor the status of responses by our suppliers that have an influence on climate change and collaborate with them to realize a decarbonized society. We will also initiate quantitative analysis of factors such as the medium- to long-term financial impact and promote disclosure in accordance with the TCFD's recommended disclosure practices.

To manage climate-related risks and opportunities, the Group calculates and continuously discloses its Scope 1, 2, and 3 emissions in accordance with the GHG Protocol and the Act on Promotion of Global Warming Countermeasure.

We will also study and set medium- and long-term Scope 1, 2, and 3 emissions reduction targets, and announce them publicly.

|

Scope |

FY11/2022 |

FY11/2023 |

FY11/2024 |

|

Scope1 |

1,100 tCO₂e |

1,259 tCO₂e |

1,033 tCO₂e |

|

Scope2 |

2,430 tCO₂e |

2,352 tCO₂e |

2,434 tCO₂e |

|

Total |

3,530 tCO₂e |

3,611 tCO₂e |

3,467 tCO₂e |

|

Category |

FY11/2022 |

FY11/2023 |

FY11/2024 |

|

1. Purchased products and services |

1,856,190 tCO₂e |

1,613,760 tCO₂e |

1,506,638 tCO₂e |

|

2. Capital goods |

340 tCO₂e |

254 tCO₂e |

508 tCO₂e |

|

3. Fuel and energy related activities not included in Scope 1 and 2 |

304 tCO₂e |

307 tCO₂e |

324 tCO₂e |

|

4. Transportation, delivery (upstream) |

196,794 tCO₂e |

188,189 tCO₂e |

378,289 tCO₂e |

|

5. Waste from business operations |

69 tCO₂e |

65 tCO₂e |

206 tCO₂e |

|

6. Business trips |

43 tCO₂e |

44 tCO₂e |

65 tCO₂e |

|

7. Employee commuting |

124 tCO₂e |

127 tCO₂e |

169 tCO₂e |

|

8. Leased assets (upstream) |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

9. Transportation, delivery (downstream) |

Calculated by inclusion in Category 4 |

Calculated by inclusion in Category 4 |

Calculated by inclusion in Category 4 |

|

10. Processing of products sold |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

11. Use of products sold |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

12. Disposal of products sold |

2,173 tCO₂e |

2,115 tCO₂e |

2,274 tCO₂e |

|

13. Leased assets (downstream) |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

14. Franchise |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

15. Investments |

Not subject to calculation |

Not subject to calculation |

Not subject to calculation |

|

Total |

2,056,036 tCO₂e |

1,804,861 tCO₂e |

1,888,472 tCO₂e |

Note:Scope 3 emissions are calculated by including the figures from consolidated subsidiaries starting from the November 2022 period.